07 Mar WEEK OF FEB 27TH, 2023

Market Indexes:

Economic Data:

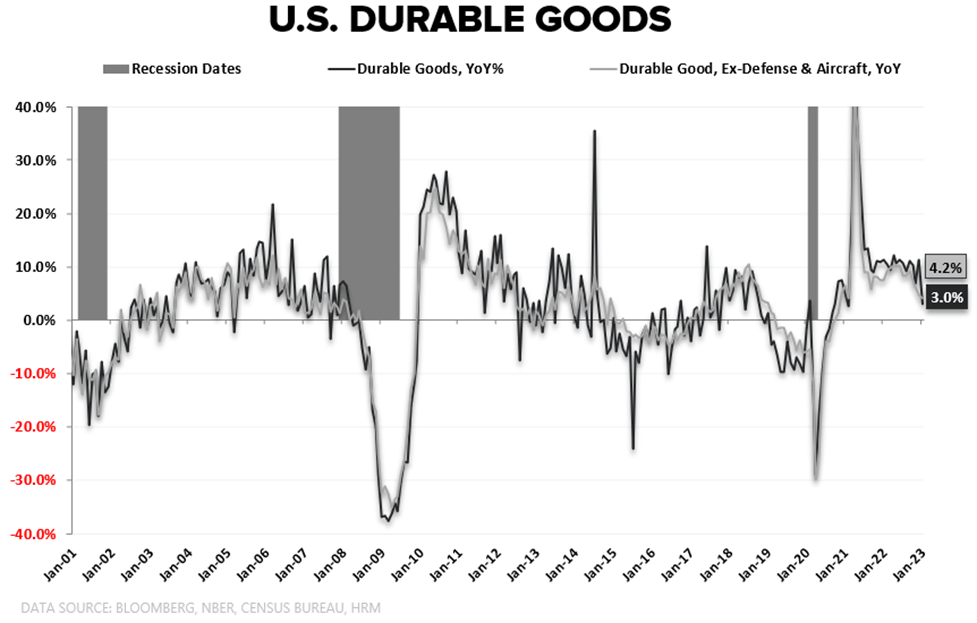

- Monday: Durable Goods Orders for January: Durables Ex-Defense and Aircraft = +0.5% M/M and slowing -30bps to +4.2% Y/Y

- Capex = +0.76% M/M and slowing -70 bps to +4.26% Y/Y.

- 2Y Comps → both series also slowed on a 2Y avg growth basis (i.e. the underlying trend remains towards deceleration)

- Headline belied by relative solidity across the internals.

- Y/Y → Continued, progressive but plodding deceleration on a Y/Y basis. Perhaps marginally surprising given the deterioration across the industrial-manufacturing complex in recent months but counterbalanced by the not irrational (resilient) capex bid in the face of historically tight/expensive labor input costs.

- Q/Q → On balance, the Durable Goods data accords with the sequential strength observed across the preponderance of high-frequency domestic macro data (Retail Sales, NFP, Jobless Claims, PCE) to jumpstart January.

- We’ll get a cleaner read on whether and to what extent January was impacted by COLA increases, omicron comps, updated seasonals and favorable weather, etc as the reported February data rolls in more forcefully over the next couple weeks.

Tuesday: February U.S. Chicago PMI slowed to 43.6, versus 44.3 in January.

- This is the second straight monthly deceleration and the second

lowest month since the pandemic.

- This regional report has also been contractionary (sub-50) for six straight months.

- Similarly, the February Richmond Fed Index fell to -16, the lowest reading since May 2020

- February U.S. Consumer

Confidence fell sharply this morning to 102.9, versus +106.0 (downwardly

revised) in January.

- Interestingly, within the report the spread between “expectations” and “present situation” fell to -83.1 -> lowest since March 2021

- Historically when the Expectations Index (short term outlook) falls below 80 (it was 69.7 in this report), it signals a recession within the year.

- 12-month inflation expectations remain elevated at +6.3%

- Home prices continue

their slide with December Case-Shiller -0.5% M/M and FHA -0.1% -> these are

in line with November’s monthly decline -> 6th straight monthly decline.

- Case-Shiller home prices were up +5.8% Y/Y in December, versus +7.6% in November.

- FHA home prices were up +6.6% Y/Y in December, versus +8.2% in November.

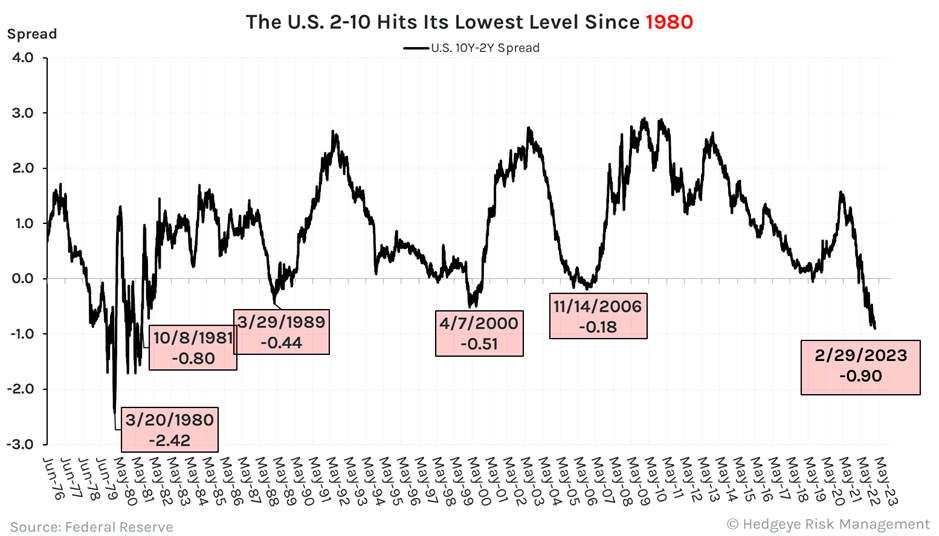

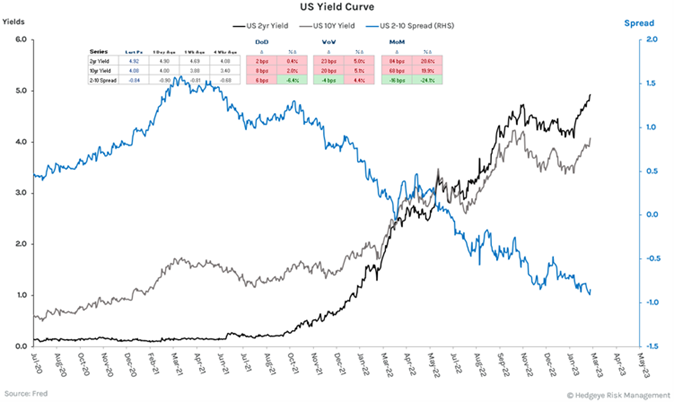

Wednesday: ISM and Markit PMIs Remain Contractionary. U.S. Yield Curve Hits a New Low at -90bps.

- U.S.

February ISM Manufacturing missed consensus slightly coming in at 47.7, which

was slightly above January at 47.4 -> 4th straight month of

contractionary readings.

- Prices paid re-accelerated after four months of declining coming in at 51.3, versus 44.5 in January.

- Markit’s

February U.S. Manufacturing PMI came in a bit lower than January at 47.3

- Similarly, the report noted “input-cost inflation eased though selling prices accelerated as manufacturers sought to pass through costs”.

- As we’ve been highlighting, there is a slight acceleration occurring in U.S. inflation readings that was further validated today.

- New low this morning on the U.S. Yield Curve (10s and 2s) at -90bps (chart below)

- With

487 / 500 SP500 companies having reported, Revenue is up +5.5% Y/Y and Earnings

are down -3.3%

- Energy earnings are a big positive driver up +55% Y/Y, which is likely to reverse sharply in coming quarters given oil and natural gas price declines.

China PMIs Accelerate Into Expansion Mode. Meanwhile Eurozone PMIs Remain Contractionary

- Acceleration

across the board in China’s February PMIs this morning as the “re-opening”

gains steams:

- China Services PMI +56.3 Y/Y, versus +54.4 in January

- China Manufacturing PMI +52.6 Y/Y, versus +50.1 in January

- China Caixin Manufacturing PMI +51.6, versus +49.2 in January

China remains the lone country globally that is seeing economic growth y/y. We continue to hold a 3% allocation in KWEB (Chinese Internet company ETF) because of this.

- Conversely, Japan’s February Manufacturing PMI remained contractionary at 47.7.

- In

the same vein, Eurozone Manufacturing PMI remained contractionary (and flat

with January) at 48.5

- The country level PMI data in Europe was essentially up small to down small.

- U.K.

Nationwide Home Prices were down -1.1% Y/Y, which was flat with January.

- This isn’t a total surprise as demand has dried up with Mortgage Approvals down -43% Y/Y (chart below)

- Finally, as we’ve seen with other inflation readings from Europe, Germany February CPI remained high and sticky at 8.7% (flat with the prior month)

Friday: ISM Services and Services PMI Basically Flat Month/Month. Yield Curve Inversion Remains Near Lows

- U.S. February ISM

Services ticked down slightly to 55.1, versus 55.2 in the prior month

- New orders accelerated to 62.6, from 60.4 -> highest since late 2021

- Meanwhile, Prices Paid Dropped by 2.2 points to 65.6 -> we had been seeing an acceleration in prices in “soft” data, so this is noteworthy.

- Net-net, the Services component of the economy, based on this report, remains expansionary with prices coming off elevated levels.

- Similarly, U.S. February Services PMI came in at 50.6, a slight acceleration versus January at 50.5

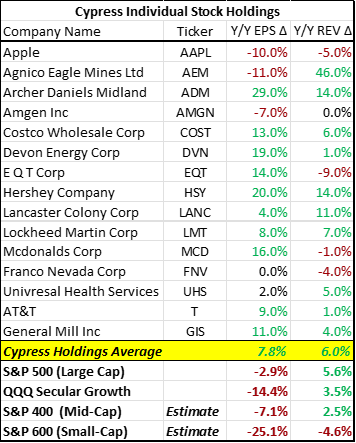

- The

earnings decline for Q4 is almost completely reported:

- SP500 revenue +5.6% and earnings -2.9%

- QQQ revenue +3.5% and earnings -14.4%

- The U.S. Yield Curve (2s and 10s) remains near inversion lows at -88bps, with two-year yields breaking out to new highs (chart below)

Earnings:

Costco (COST) reported FQ2 EPS of $3.30 vs. consensus of $3.21. Same store sales grew 5.8% ex fuel in the U.S. and 6.8% for the total company without fuel and Fx. Traffic increased by 5.0% worldwide and 3.7% in the U.S. Ticket increased 0.2% worldwide and 1.9% in the U.S. Memberships grew 7% YOY and the renewal rate improved by 0.1%. Management said a membership fee increase timing is “when not if.” In February, food and sundries inflation was +High Single Digit % (decelerating from and fresh foods were up low to MSD%, the lowest in nearly a year.

Gross margins expanded 8bps or 9bps ex fuel. Core merchandise margins contracted 6bps. Lapping a LIFO charge contributed 14bps YOY. Management said inflation seems to have improved somewhat with commodity relief. SG&A deleveraged 13bps. Inventories were 2% lower YOY with improvements in the supply chain.

Costco is a Best Idea long. Warehouse clubs are gaining share within food retail. Costco offers its members a compelling value proposition in a time of challenging food inflation. It is taking share and driving customer traffic. The membership fees and overall scale provide unparalleled EPS visibility.

Nearly all of our individual stock holdings have announced quarterly earnings and as you can see in the chart below, our holdings are out-performing the overall indexes in both earnings and revenue growth. This is something we pay close attention to during bear markets and recessionary periods. We will continue to add high quality companies that can grow earnings in difficult environments in client portfolios.

Sorry, the comment form is closed at this time.