13 Feb Week of Feb 6th, 2023

Market Indexes:

Economic Data:

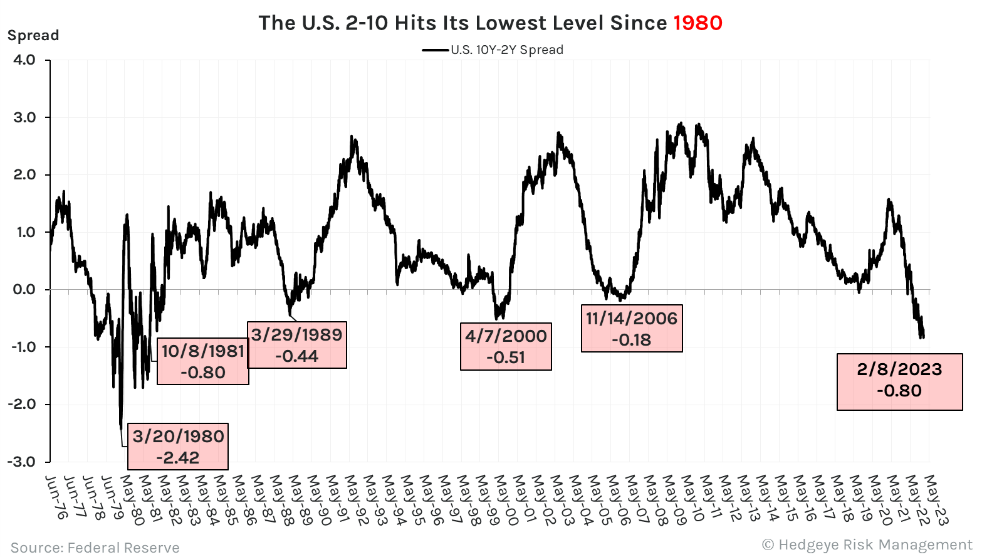

Wednesday: Small Bounce in Mortgage Apps +3.1%. Yield Curve Remains Inverted -0.80%, While Rate Expectations Tick Higher. We saw a bounce this morning in US MBA Mortgage purchase applications at +3.1% W/W, versus -10.3% in the prior week.

With 51 of the 100 constituents of the QQQs having reported, revenue is up +2.2% and earnings are down -16%

The SP500 is tracking at +5.2% sales growth and -3.1% earnings growth with 291 companies having reported

The U.S. Yield Curve remains at -80bps, which is near the lowest levels since 1980

Rate hike expectations continue to tick higher with an additional 0.50 hikes priced into Fed Funds Futures since the last rate announcement

We had better than expected Y/Y home prices increase in the U.K., which came in at +1.9% Y/Y in January. Expectations were for a -0.3% Y/Y decline, the December report was up +2.1% Y/Y

Friday

February preliminary Michigan Consumer Sentiment ticked up to 66.4, from 64.9 in January

Within the report one of the more interesting takeaways is the inflation expectations within the next year accelerated to +4.2%, from +3.9%

**Consistent with much of the global inflation data over the past few weeks, we are seeing a modest re-acceleration in this indicator

The release noted “high prices continue to weigh on consumers despite some recent moderation and argued this combined with concerns about rising unemployment could weigh on consumer spending in the months ahead.”

Earlier this week, the Manheim Used Car Index came out which increased +2.5% M/M from December to January, though remained down -12.8% Y/Y

**Used Cars make up ~4.5% of Core CPI, so a roughly 1% increase will add 5bps to Core CPI

Below: Current look at the 2yr/10yr yield curve, a historically accurate predictor of economic recessions. The current reading is a bone-chilling -.80, the largest inversion since 1980.

Sorry, the comment form is closed at this time.