20 Mar Week of March 13th

Market Indexes:

March 11, 2023

It is fair to say that Fed Chair Jerome Powell stole the show on the Street this week as, despite the already hawkish expectations, shocked the market with his stark words regarding inflation. Small-caps and financials were crushed in the wake of Mr. Powell’s statements, and even though tech stocks, the Nasdaq, and global equities showed resilience, the large-cap benchmarks still closed in the red for the week, close to their recent pullback lows.

In addition, a mixed bag of job market indicators, the failure of Silicon Valley Bank (SIVB), and the Biden administration’s budget proposal made major waves across financial markets as well. What happened with SIVB? Here’s a summary:

Silicon Valley Bank saw massive growth between 2019 and 2022, which resulted in it having a significant amount of deposits and assets. While a small amount of those deposits were held in cash, most of the excess was used to buy Treasury bonds and other long-term debts. These assets tend to have relatively low returns but also relatively low risk. But as the Federal Reserve increased interest rates in response to high inflation, Silicon Valley Bank’s bonds became riskier investments. Because investors could buy bonds at higher interest rates, Silicon Valley Bank’s bonds declined in value. As this was happening, some of Silicon Valley Bank’s customers—many of whom are in the technology industry—hit financial troubles, and many began to withdraw funds from their accounts. To accommodate these large withdrawals, Silicon Valley Bank decided to sell some of its investments, but those sales came at a loss. SVB lost $1.8 billion, and that marked the beginning of the end for the bank.

Some people believe that Silicon Valley Bank’s failure started far earlier with the rollback of the Dodd-Frank Act, which was the major banking regulation that was put into effect in response to the financial crisis of 2008. As a part of Dodd-Frank, banks with more than $50 billion in assets would be subject to additional oversight and rules. However, the 2018 Economic Growth, Regulatory Relief, and Consumer Protection Act, signed into law by President Donald Trump, significantly changed that requirement. Instead of setting the threshold at $50 billion, the 2018 law increased it to $250 billion.

Despite being the 16th largest bank in the country, Silicon Valley Bank didn’t have enough assets to be subject to the extra rules and oversight. If the threshold was never changed, SVB would have been more closely watched by regulators.

Federal regulators decided to fully insure and protect all of Silicon Valley Bank’s depositors and their balances for fear of contagion—the impact the bank’s collapse could have on the economy. Amid the bank collapse, it was not just Silicon Valley Bank whose stock price plummeted. Other banks saw their stock prices drop, too. A high-profile bank failure like this one could reduce consumer confidence in the banking system. That lack of confidence could create more of the problem that contributed to Silicon Valley Bank’s failure—account holders rushing to withdraw deposits from a bank that doesn’t have the funds to cover them. Ultimately, this risk of contagion could affect not just banks but the economy as a whole.

March 18, 2023

Even though the past couple of weeks saw the most significant banking crisis in the U.S. since 2008, apart from small-cap banks, stocks got through the week without outsized losses. Tech stocks even hit one-month highs in the second half of the week as rate hike odds plummeted, giving bulls hope that the next leg higher in the recovery is just around the corner. Despite the Fed’s and the Swiss National Bank’s (SNB) emergency steps, the European Central Bank (ECB) followed through with its plans, hiking its benchmark rate by 0.5%, suggesting that the financial sector remains stable across the globe.

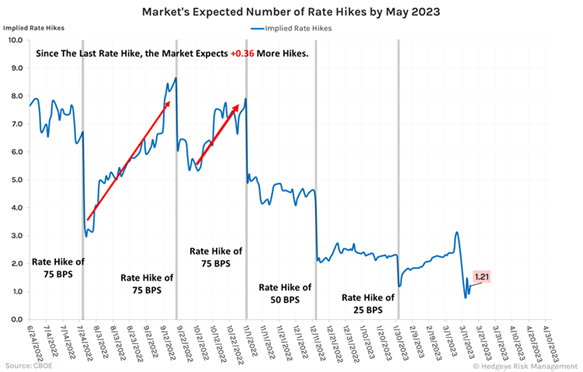

We are in for a potentially decisive week of trading in stocks, as Wednesday’s Fed’s rate decision and monetary statement and the market’s reaction to them could determine the direction of the next major move on Wall Street. Most analysts expect another 0.25% rate hike from Jerome Powell & Co., but in light of the past couple of weeks’ turmoil in the banking sector, a pause in the Fed’s tightening cycle would not be a real shocker, but we do expect Powell to raise .25. As for the economy, existing home sales will come out on Tuesday, new home sales will highlight Thursday’s session, while we will get the durable goods report and the Markit manufacturing and services PMIs on Friday.

We continue to see deteriorating economic and market data each week. If you have been reading our quarterly Cypress Reports, you know that we have been expecting this. We continue to have a “Capital Preservation” strategy in place with overweight positions in short term fixed income, gold, and stocks in the consumer staples sector. We will remain defensive until we begin to see the data improve.

Economic Data:

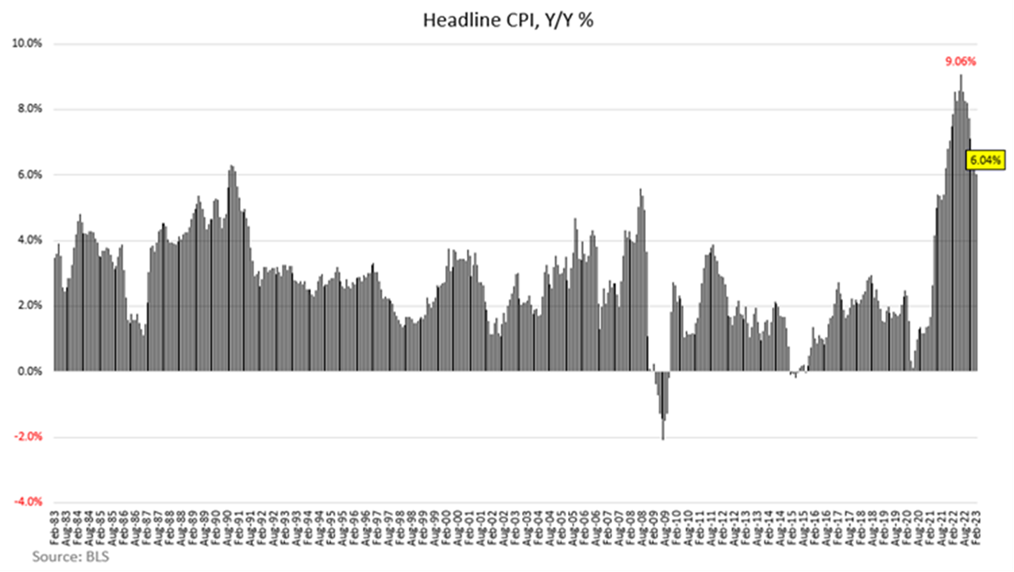

Tuesday: February Consumer Price Index (CPI): Headline CPI came in exactly on target while Core inflation was hotter than estimates, rising +0.5% M/M, but ….

- 70% of the increase was from further acceleration in OER/Shelter (+8.1% Y/Y)…. which everyone knows is set to decelerate … but which everyone knew that everyone knew last month also (and the month(s) prior).

- Used Auto CPI slowed, diverging from Manheim which showed February rising at the fastest pace in over a decade, so someone is wrong.

- Food Prices decelerated but are still running +10.2% Y/Y, and …

- Inclusive of those decelerations, Core Inflation still beat, and …

- The all-important Core Services Ex Housing series decelerated modestly but, again, not the kind of “progress” supportive of a hawkish relent.

So a bit of a something-for-everyone report (still too hot but incremental deceleration + scope for some select dovish interpretation) while at the same time also a ‘nothing’s really changed’ report.

In short, the CPI data argues for further Fed hikes, financial stability risk argues for a cautionary touch and market vol argues that no one knows what’s going on/what the fed is going to do, only that the situation is not the same as it was a week ago.

Thursday: Weekly Jobless Claims Drop To +192K. Import and Export Prices Down Y/Y For First Time Since Late 2020

• After ticking up last week, Weekly Jobless Claims decelerated this week to +192K from +212K last week

o Continuing Claims were flat at +1.713MM

o While there are some cracks emerging in the labor market (job listings as an example), weekly jobless claims remain near generational lows.

- Similar to the Empire State Manufacturing Survey from yesterday, the Philly Fed Index also came in lower than expectations today at -23.2

o On the deflation front, prices paid dropped to the lowest level since August 2020

- U.S. Import and Export prices came in a bit hotter than consensus, though slowed on an annual basis

o Import Prices were -0.1% M/M and are down -1.1% Y/Y -> so U.S. imports are now deflationary for the first time since December 2020

o Export Prices were +0.2% M/M, but also down -0.8% Y/Y -> similarly the first Y/Y decline since November 2020

- The Fed is obviously in a conundrum next week. Labor remains tight and inflation is slowing in some areas (PPI), but remains high and sticky in others (CPI)

o Then there is the regional banking “crisis” (for lack of a better word). Interestingly, the ECB shook off any concerns around Credit Suisse and hiked by 50bps this morning . . .

- U.S. Bond Volatility, as measured by the Move Index, is close to eclipsing 200 and is closing in on the all-time high during the GFC of ~214 in November 2008

- ECB Hikes By 50bps. Eurozone Inflation Reports Remain High and Sticky

- As mentioned above the ECB hike rates by 50bps and according to Lagarde “no other option than 50bps was discussed.”

Sorry, the comment form is closed at this time.