30 Jan January 27th, 2023

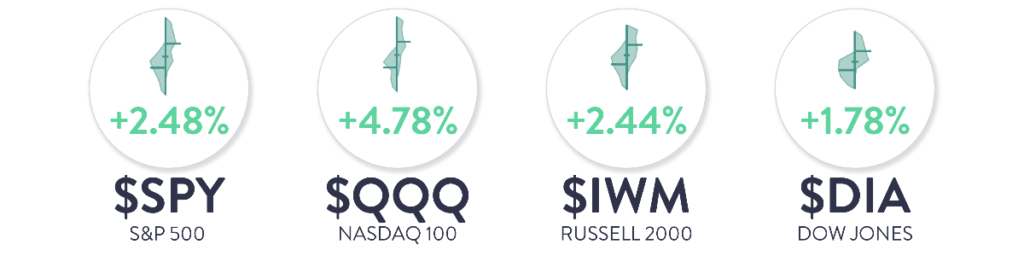

Market Indexes:

An optimistic week as traders seem to be awaiting the Fed’s decision on Wednesday, Feb 1st. Will they hike by 50 bps or 25 bps? All evidence points to the Fed remaining hawkish – GDP was released this week coming in at +2.9% growth Q/Q and jobless claims dipped down by 6,000 to 186,000 – the lowest reading since April 2022. The unemployment rate remains steady at 3.6%, which will be the catalyst (should we see the number start to increase) to when the Fed really turns dovish or possibly even begin to…….pivot? We ended the week with a total of 137 of the S&P500 companies having reported, revenue is up +5.4% Y/Y and earnings are down -2.5%. A recessionary indicator, the yield curve, still remains inverted at -.66%.

Economic Data:

Redbook Retail Sales numbers came in at a disappointing +4.6% Y/Y -> the lowest reading in a year

- Consumer spending is slowing

- Apparel Retailers have way too much inventory

M2 Data for December showed domestic money supply contracting to a new all-time low at -1.31%

- Real income growth is negative, savings rates are at multi-decade lows, nominal debt obligations are rising and now the amount of money available to pay these obligations is contracting

U.S Services PMI printed below consensus at a contractionary 45

U.S Manufacturing PMI printed at 46.8 (contractionary)

- Manufacturing Employment went sub-50 for the first time since 2020

- Input costs (labor) are accelerating while output prices continue to fade

Mortgage application data showed Purchase demand rose +3.4% W/W -> the highest since August

Inflation data in the U.S. continues its deceleration with PCE Price Index slowing to +5.0% Y/Y in December, from +5.5% Y/Y in the prior month

Similarly, Core PCE slowed to +4.4% Y/Y, from +4.7% in November -> lowest since December 2021

- While the deceleration is real, Core PCE is still at levels (absent the recent rise) last seen in 1989 (Fed Funds Rate averaged 9.2% in 1989)

Personal Income was up +0.2% M/M and ended Q4 2022 +5.8% Y/Y

- That said, disposable personal income was negative -1.7% Y/Y for December and-2.3% Y/Y for Q4

Michigan Consumer Sentiment in January accelerated to 64.9, which was above consensus and +9% from the prior month -> highest level since April 2022

Pending Home Sales for December in the U.S. surprised a bit to the upside at +2.5% M/M, versus down -2.6% M/M in the prior month

- On a Y/Y basis, they remain down -34%, which is a three month “high”

Company Data:

Lockheed Martin (LMT) announced earnings this week and beat on both EPS and Revenue. $7.40 EPS and $19 billion up 7% YoY with backlog growing 11% to $150 billion. LMT Board of Directors also announced a $3.00/per share dividend payable to shareholders on March 24, 2023.

AT&T (T) reported fourth quarter earnings on Wednesday topping estimates with revenue coming in just below Wall Street estimates. Their full year free cash flow topped their own estimates causing the stock to pop 7%. $14 billion in free cash flow supports AT&T’s healthy 5.5% dividend.

A strong earnings report from Archer-Daniels Midland (ADM) reported this week. Revenue came in at $101.8 billion for the year, up 20% from 2021. Net Income was up 60%, profit margin was up 3.2% driven by higher revenue and EPS came in at $7.71, up from $4.80 in 2021. They also increased their dividend 12.5% to $.45/quarter or 2.2% annualized.

Companies to report this week: Amgen Inc (AMGN), McDonald’s (MCD), Apple (AAPL), Hershey Co (HSY), and Lancaster Colony Corp (LANC)

Sorry, the comment form is closed at this time.