15 May May 8th – 13th

Market Indexes:

Weekly Market Commentary

| The week kicked off with the news that JP Morgan (JPM) was buying most assets of First Republic (FRC), the third bank to fail in a matter of months, and while the market’s initial reaction was positive, regional banks were quickly under severe pressure, which led to a broad-based selloff in stocks. The ongoing debt ceiling drama also weighed on investor sentiment as the risk of a technical U.S. default increased with the Fed’s and the European Central Bank’s (ECB) monetary meetings adding to the volatility in risk assets as well. Apple’s (AAPL) bullish earnings provided much-needed support to the market toward the end of the week, but the tech sector’s relative strength was not enough to save the week for bulls as the major indices all closed notably lower. While the week’s economic releases leaned bullishly, Treasury yields still closed deep in the red due to the Fed’s slight dovish shift and the bank sector’s troubles. The ISM manufacturing and services PMIs, non-farm payrolls, the unemployment rate, hourly earnings, the ADP payrolls number, the Wards vehicle sales number, and the trade balance all provided bullish surprises, but that was not enough to calm investors’ nerves amid mounting recession fears. On a negative note, the job market sent a few bearish signals as well as the JOLTS job openings estimate hit a nearly two-year low, the Challenger job cuts estimate tripled on a year-over-year basis, while new jobless claims ticked higher, which could indicate a slowdown in job growth for the coming months. The short-term technical picture continues to be bullish, at least at the level of the major indices, but this week’s pullback hurt the short-term outlook for stocks. That said, the Dow, the Nasdaq, and the S&P 500 are still trading up above their 50-day moving averages, and the benchmarks continue to be well clear of their 200-day moving averages. Small-caps had a dismal week, with the Russell 2000 getting very close to its March low, and the index closed the week well below both its moving averages. The Volatility Index (VIX) spiked to its highest level since late March, topping the widely-watched 20 level, but “fear gauge” finished the week well below its 50-day moving average again. Market internals deteriorated as the Russell 2000 remained under pressure, with the tech key breadth measures hitting their lowest levels since mid-March. The Advance-Decline line plunged to a six-week low, as decliners outnumbered advancing issues by a 5-to-1 ratio on the NYSE and a 2-to-1 ratio on the Nasdaq. The average number of new 52-week highs increased on both exchanges, rising to 55 on the NYSE and 43 on the Nasdaq. The number of new lows jumped higher in the meantime, surging to 105 on the NYSE and 296 on the Nasdaq. The percentage of stocks above their 200-day moving average dropped back below the 40% level following last week’s recovery, but the measure bounced back again to close the week at 41%, well above its year-to-date low. |

Economic Data

Tuesday :

Senior Loan Survey Shows Lending Standards Tightening Across The Board. New Lows On Small Business Sentiment

- U.S. Redbook Weekly Retail Sales remain in the doldrums at cycle lows for the second week in a row of +1.3% Y/Y

- NFIB Small Business Sentiment hit another new cycle low at 89.0 (chart below)

- This is lower than the depths of the pandemic and the lowest level in more than a decade

- The forward outlook components of this data series remained near all-time lows at -49 !

- The April Senior Loan Officer Survey showed tightening standards, increasing spreads, and lower demand across literally all loan types (full table below)

This question and answer from the survey is somewhat case in point:- (3) How and why do banks expect lending standards to change over the remainder of 2023?

- Banks expect to tighten standards across all loan categories based upon an expected deterioration in the credit quality of their loan portfolios and in customers’ collateral values, a reduction in risk tolerance, and concerns about their funding costs, liquidity position, and deposit outflows.

ECB Continues with Hawkish Commentary. China Exports and Imports Slow

- Yesterday’s May Eurozone Sentix Economic Index decelerated to -13.1, versus -8.7 in April

- Germany March Industrial Production slowed on a M/M basis to -3.4%, versus +2.1% in the prior month

- The U.K. Halifax Home Price Index slowed to +0.1% Y/Y, versus +1.6% in the prior month -> worst Y/Y change in home prices in a decade plus

- Note: other measures of U.K. home prices have declined more significantly

- According to the British Retail Consortium, retail sales in the U.K. remained flat in April at +5.1% Y/Y

- When adjusting for inflation, volume is down -3 to -5% Y/Y

- We are getting a slew of bearish rhetoric from ECB officials last night and this morning:

- Bundesbank Chief Nagel said “more hikes needed as inflation extremely high”

- ECB Chief Economist Lane said “expects inflation to slow this year but momentum still very high in food and core inflation”

- Dutch Central Banker Knot called for “more hikes”

- Slovakian Central Bank Chief Kazimir “highlighted that September is likely to be the earliest when policymakers can judge whether past rate hikes have been effective”

- Both China Exports and Imports slowed in April to +8.5% Y/Y and -7.9% Y/Y, respectively.

- Interestingly, exports to Russia were up 153% Y/Y!

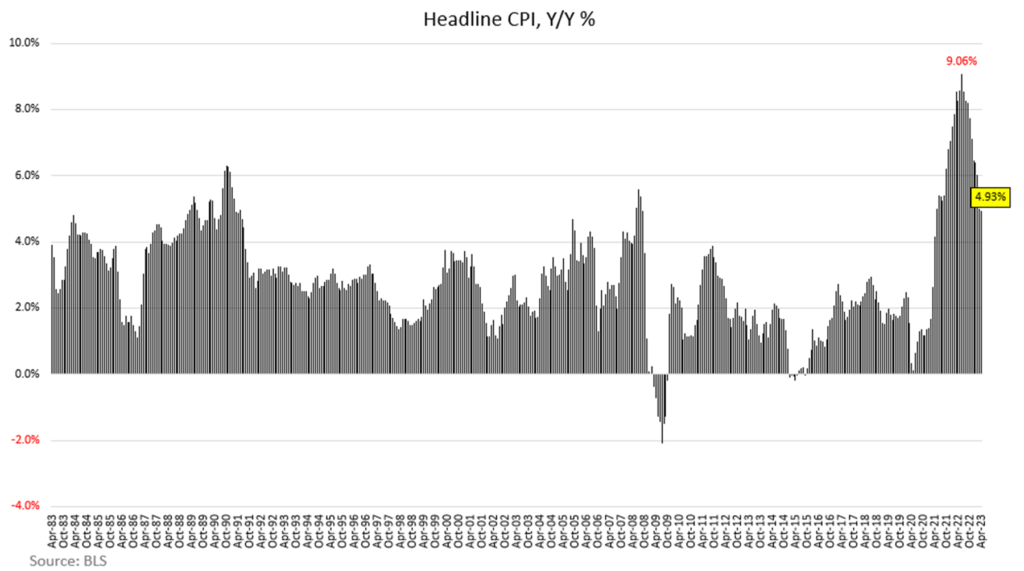

Wednesday: – Headline CPI breaches 5% to the downside for the first time in 2 years. The world exhales, markets bask in the warm glow of green futures and, for a moment, we turn a willfully blind eye to the inexorable march of the cycle to indulge in a moment of ‘it-could-have-been-worse’ bliss ….

- Headline = +0.4% M/M = decelerating -10 bps to +4.9% Y/Y (*technically, last month was sub-5% at +4.98% if you’re not a rounding maxi).

- Core = +0.4% M/M = decelerating -10 bps to +5.5% Y/Y

- Shelter Inflation = the peak appears to be in with Shelter inflation decelerating -7bps to +8.1% Y/Y = 1st month of Y/Y deceleration in 26 months

- Core Services ex Shelter = +0.27% M/M = decelerating -56bps to +5.12% Y/Y

In short, a necessary-but-not-sufficient kind of dynamic policy as ‘progress’ continues to run parallel with ‘more work to do’.

We are now pushing towards 17-months of macro deceleration – a somewhat historically anomalous cycle cadence complements of historically anomalous monetary-fiscal ‘cooperation’ amidst mostly anomalous exogenous shock conditions.

That anomalous policy response and the associated stimulus has meant less sensitivity, in aggregate, to slowing macro conditions and less sensitivity, in aggregate, to higher rates & monetary tightening (b/c of the transitory tethering to income/savings, not credit).

Again, all the above is true until it isn’t. And while Quad 4 remains the existent and probable future macro trajectory, the “until it isn’t” is a when, not an if, and the “trap door” scenario vis-à-vis consumption and capex remains more than a far left-tail risk.

On balance, April represents another month of trudging price disinflation drudgery as residual supply renormalization and ongoing demand deceleration result in what supply increases and falling demand are expected to do to prices.

Sorry, the comment form is closed at this time.